Key Performance Indicators (KPIs) are defined as quantifiable measures used to evaluate the success of an organization, employee, etc. in meeting objectives for performance. (Oxford Languages) It is important for professional service organizations to create finance KPIs that will bridge the gap between financial information and business strategy to give key insights into how the organization is performing. Finance KPIs look into the health of your organization and regularly evaluating the right performance metric will help you identify potential problems before they become significant, allowing you to take proactive measures to overcome them. Finance KPIs for professional service organizations are particularly important because the professional services market is more competitive than ever. Finance KPIs will help identify which areas of your organization are underperforming, whether it is products, departments, or something else, and correct them before a significant amount of income is lost. Below are 5 crucial finance KPIs for professional service organizations that can monitor and improve business performance.

1. Annual Revenue per Billable Consultant

Total Revenue/Number of Consultants

Annual Revenue per Billable Consultant is a measure of an organization’s total revenue divided by the number of billable consultants they employ. This performance metric is a key factor in tracking productivity. In order to get an overall view of effective billable output, compare this metric against labor costs. Revenue per billable consultant should ideally equal one- to two-times the labor costs of employing each consultant.

2. Annual Revenue per Employee

Total Revenue/Total Number of Employees

Annual revenue per employee is a measure of an organization’s total revenue divided by the number of employees they have, billable and non-billable. This performance metric differs from revenue per billable consultant because it measures overall organizational efficiency. Revenue per employee is especially important in determining the appropriate size and financial health of the organization and this figure should be close to two times the fully loaded cost per person to maintain strong business performance.

3. Billable Utilization

Billable Hours/2000

Employee utilization is defined on a 2,000 hour per year basis therefore, billable utilization is measured by dividing the total billable hours by 2,000. This performance metric is a key factor in tracking how well your organization is utilizing assets. This finance KPI is important because it tells if you need to expand or contract, as well as how well you are maximizing opportunity.

4. Project Overrun

Budgeted Cost/Actual Cost

Project overrun is the percentage above budgeted cost versus the actual cost of the project, and it is measured by budgeted cost divided by actual cost. This performance metric is important because project overrun will negatively affect profitability and can limit the launch of new projects. Project overrun is often associated with decreased customer satisfaction and may suggest that project management needs to be improved.

5. Profit Margin

Project Revenue/Project Cost

Project margin is the percentage of revenue which remains after paying for the direct costs of delivering a project and it is measured by project revenue divided by project cost. There are many ways for professional service organizations to bill their projects but regardless, it is important to keep margins above 40%. Low project margins are frequently linked to poor financial performance, as firms are unable to invest in future growth initiatives.

Finance KPIs for professional service organizations can be complex to navigate and focusing on the wrong ones can be a waste of time. By concentrating on the 5 finance KPIs above, you can ensure you are measuring the proper performance metrics to improve business performance.

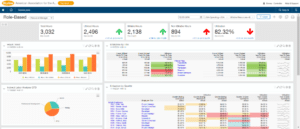

If you are interested in seeing these metrics in a customized demo for your organization and learning how Sage Intacct can help streamline business processes and foster growth- giving you full visibility into the KPIs and financial metrics for your professional services organization, please email us!

CompuData is a proud Sage Intacct Partner and has helped our clients implement Sage products across the nation for over 30 years. To learn more about our Sage Intacct expertise and how we can help your organization focus on the most important finance KPIs for professional service organizations to increase business performance, visit here.