Sage Intacct 2023 Release 4 consists of new features and functionalities designed to streamline operations, simplify financial management processes, and enhance efficiency for your business. Discover what’s new in the latest version of Sage Intacct and how you can leverage the product updates.

Sage Intacct 2023 Release 4 Highlights Include:

- Advanced Ownership Consolidation

- Streamlined Match Sequences for Reconciliation

- Enhanced Workflows with Bank Transaction Assistant

- Single Payments for Multiple Customers

- Printed Deposit Enhancements

- Limit Future General Ledger Postings

- Fulfillment for Sales Order Management Now Available

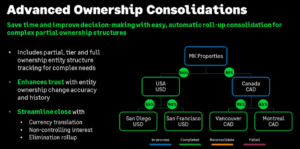

Introducing Advanced Ownership Consolidation

Sage Intacct 2023 Release 4 introduces Advanced Ownership Consolidation, a new subscription that provides partial ownership through tiered consolidation.

The Advanced Ownership Consolidation feature simplifies the consolidation process at the entity level, accounting for varying ownership percentages by period. It integrates ownership percentages seamlessly into the consolidation process. Sage Intacct’s streamlined multi-level consolidation, facilitated by partial ownership considerations, empowers your business to save valuable time and resources. This efficiency boost enhances overall accuracy in financial operations.

Here are the key benefits of Advanced Ownership Consolidation:

- Enhanced Accuracy and Efficiency

- Transparent Financial Reporting

- Workflow Streamlining

- Complex Ownership Management

- Seamless Reporting Integration

With these features, Sage Intacct empowers your business to navigate complex financial landscapes with ease, ensuring accuracy, transparency, and efficiency throughout the consolidation process.

Easily Identify Matched Reconciliation Transactions with Match Sequences

With Release 4, Sage Intacct enables you to gain visibility into your bank and credit card reconciliation matches with match sequences. You can set up a bank or credit card account to generate a sequence for matched, partially matched, and draft matched transactions. You’ll know which transactions matched to which based on the generated sequence.

Each time a transaction is matched, a unique sequence is assigned in the form of lower-case letters to each transaction. When you reconcile, the letters become capitalized.

During reconciliation, a match sequence value is assigned for:

- Automatically matched transactions from an import file or bank feed.

- Manually matched transactions without a corresponding bank transaction.

- All manually matched transactions receive the same match sequence.

- Partially matched transactions.

- Draft matched transactions.

If you unmatch transactions, the sequence value is removed. This sequence value will not be reused, so if you rematch the transactions a new value is used.

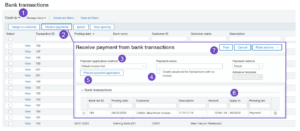

Improve your Workflow with Bank Transaction Assistant

Optimize your Accounts Receivable payment processing and expedite reconciliation by leveraging the Bank Transaction Assistant workflow.

Key Features:

- Effortlessly associate customers with bank transactions, streamlining the receipt of multiple payments from various customers directly on the Bank Transaction page.

- Post payments in Sage Intacct, and watch as they seamlessly align with bank transactions, automating the reconciliation process.

- For businesses with multiple entities and currencies, efficiently handle advances and payments at the entity level.

- Enhance your experience with the Bank Transaction Import Early Adopter feature, allowing imported transactions to be conveniently displayed on the Bank Transaction list.

To receive a payment, first assign a customer to bank transactions. You can automate this process by creating an assignment rule.

Step 2: Receive payments in bulk

When a bank transaction has a customer assigned, you can receive a payment or create an advance. You can also receive payments in bulk. If there’s no invoice for the customer, you can create an advance using the new AR advances template.

You’ll need the new Cash Management permission to Receive payments from bank transactions.

Receive Single Payments for Multiple Customers

Exciting news for all Sage Intacct users! This latest enhancement, now available to everyone and not just Early Adopters, facilitates the allocation of a single payment to invoices from multiple customers.

To handle scenarios where payments must be distributed among invoices for various customers, Sage Intacct’s Accounts Receivable can now be configured to seamlessly accommodate such situations during the payment receipt process. Once this feature is configured, you’ll notice the option to apply payments to either a single customer or multiple customer accounts on the Receive Payment page.

Options include receiving a payment for the following:

- One customer’s invoices.

- Parent and child customer invoices.

- Multiple customers’ invoices.

When receiving a payment for multiple customers, the Payer name field appears.

Printed Deposit Enhancements

Gain enhanced insight into individual transactions within a deposit by utilizing the improved deposit printing feature in Sage Intacct. In Release 4, we have refined the format and content of printed deposits.

The entity information for the bank deposit now takes a prominent position at the top of the deposit slip, aligning with the deposit date, ID, description, and bank name. Furthermore, when you opt to print a deposit in Sage Intacct, you will now find additional details for each transaction included in the deposit:

- Payer

- Customer ID

- Currency

- Base amount

- Payment method

- Summary

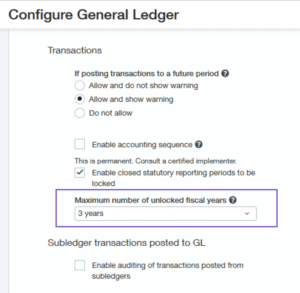

Control How Far into the Future you Allow GL Posting

Embrace newfound control over your fiscal year management with the latest Sage Intacct 2023 Release 4 feature. Now, you have the capability to set limitations on the number of unlocked fiscal years you have. This is especially important in regions where you’re required to set a limit.

Your unlocked fiscal years follow your locked period, granting you control over how far into the future you can post. Limiting your unlocked fiscal years plays a pivotal role in protecting the integrity of your data, acting as a preventive measure against accidental postings to distant future dates.

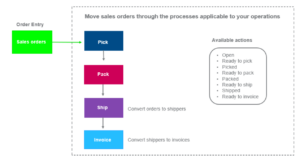

Announcing General Availability of Fulfillment for Sales Order Management

Fulfillment for sales order management is now accessible to all customers, having successfully transitioned from its early-adopter phase.

Fulfillment equips warehouse managers and workers with the necessary tools to efficiently track and dispatch sales orders, ensuring timely deliveries that delight customers. The system also generates pick and pack lists, optimizing the workflow for warehouse personnel and reducing operational costs. Additionally, as sales orders progress through the fulfillment process, Sage Intacct strategically reserves and allocates quantities, preventing their use elsewhere.

With this new capability, you have the flexibility to manage sales orders seamlessly, whether it involves the pick, pack, ship, invoice, or any combination of these processes—all conveniently accessible from a single page.

With these new capabilities, Sage Intacct 2023 Release 4 can help optimize your accounting processes and enhance overall productivity.

CompuData understands that every business is different and has unique needs. Our team designs sophisticated intuitive accounting solutions to support your organization. Let CompuData’s team of experts work with you to meet your business objectives leveraging the power of Sage Intacct.

If you would like to learn more about the new enhancements of Sage Intacct’s latest release, email us!