Sage Intacct 2025 Release 2 delivers a wide range of enhancements designed to elevate financial reporting, streamline workflows, and boost overall efficiency. This update introduces powerful new tools and features that help organizations gain deeper insights and greater control over their financial data.

With notable improvements across AI-driven automation, Accounts Payable and Receivable, cash management, and a more intuitive import experience, this release is crafted to simplify processes and enable faster, more accurate decision-making.

Let’s take a closer look at the key features and enhancements in this release—and explore how they can help your team work smarter and get the most out of your financial system.

AI Automation:

1. Automate Employee Expenses with the SIT Mobile App – Early Adopter

The Sage Intelligent Time (SIT) mobile app now supports employee expense automation so that you can capture receipts, submit expense reports, and approve or decline them from a mobile device quickly. This enhancement aims to boost efficiency, reduce errors, and quicken reimbursements for employee expense reports.

With this new release, you can do the following using the Sage Intelligent Time mobile app:

- Create, edit, delete, split, and submit expense reports

- Upload, edit, and delete expense receipts

- Create and edit time clocks

- Create and submit timesheets

- Approve or decline expense reports and timesheets

2. Streamline AP Transactions with AI and Purchasing Integration – Early Adopter

Boost efficiency by combining AI-powered transactions with the flexibility of the Purchasing application. You can now automate transactions that do not have a source match defined, for example, vendor invoices that do not start with purchase requisitions or orders.

AP Automation with Purchasing streamlines transaction entry by automatically creating draft transactions from documents that you email or upload. Sage Intacct identifies the vendor and fills in certain transaction details for you, such as location, department, and item IDs.

With Sage Intacct 2025 Release 2, you can do the following:

- Configure transaction definitions to automate transactions that do not have a previous transaction to match with in the purchasing workflow.

- Change the transaction type for incorrect predictions, which feeds back to the machine learning model to improve future predictions.

- Get the benefits of both automated transaction matching and standalone transactions. You have the flexibility to set up both options or use just one, depending on what best fits your needs.

Document sequences are no longer required for transaction definitions that you select to automate. This gives you more flexibility with the automation, allowing you to add document numbers after the draft is generated.

3. Customize Supplies Pick Lists and Reports to Improve Workflow Efficiency

If your business has unique warehouse picking requirements, this update gives you more control. You can now customize Supplies Inventory pick list templates and reports to help your team fulfill requests faster and track key data for better analysis.

Here’s how the new customization options can support your workflow:

- Customizable pick lists give warehouse staff the details they need to quickly find items.

- Procurement users can sort and print requisition lines in pick reports for better evaluation of picking history.

- Users with Platform Services permissions can export, customize, and upload pick list and report templates.

Order linking supports bulk purchases, accommodates varying delivery dates, and improves supply availability. If a supplier is out of stock, managers can reallocate from existing POs. Linking requests to standing POs improves efficiency and reduces costs.

The new linked PO feature also helps you:

- Identify surplus quantities on order

- Allocate pre-ordered items to high-priority requests

- Unlink requests when items are no longer needed

Sage Intacct Import Service—General Availability:

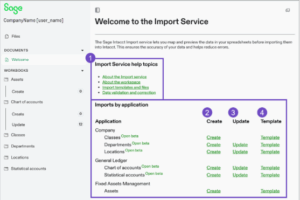

Importing data is a critical function for accountants and partners. Instead of sending your data into a “black box” and waiting for error reports via email, you now have a dedicated import workspace that provides real-time visibility and control.

The new import service is now generally available for a limited set of import types and provides the following benefits:

- Expanded capabilities: Import from multiple tabs, use formulas, and add extra columns.

- Real time error handling: Errors are displayed on the page, at the field level, and easy to understand and correct before finalizing your import.

- Intuitive interface: You can use find/replace to correct errors, search for specific values, and filter by errors.

On the Company Setup Checklist page, you’ll see a new import service link at the top of the page. Select the link to open the import service workspace, where you’ll have access to helpful resources and tools, including:

- Import service help topics.

- Links to Create for available imports.

- Links to Update lines for available imports to update existing records.

- Templates available for imports to add your data and follow the import process.

When all errors are resolved on your import sheet, you can import the data into Intacct.

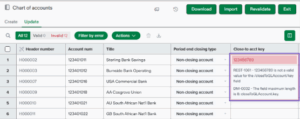

Below is an example of an error message that you might see in the import service before import.

Accounts Payable Enhancements:

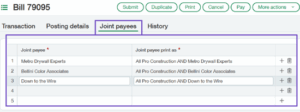

1. Joint Checks

If you handle bills from vendors who subcontract parts of their work and need to pay both parties, you’ll appreciate the new joint checks payment method, now available to all Accounts Payable subscribers.

With joint checks, you can add one or more joint payees to a bill and issue two-party checks. Payments to joint payees can be made at either the bill level or line level.

To set up a joint payment, simply add one or more joint payees to a saved bill.

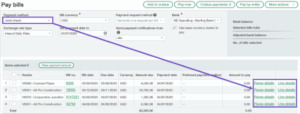

Pay joint payees by selecting Joint check as the payment method on the Pay Bills page.

The Amount to pay field summarizes the amounts you enter in the Payee details or Payee line details sections.

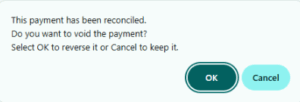

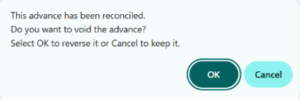

2. New Warning When Voiding a Reconciled Transaction

A new warning feature helps you avoid unintended changes to reconciled periods by alerting you when you try to void payments.

If you attempt to void a reconciled payment, manual payment, or AP advance, Sage Intacct will notify you that the transaction has already been reconciled. This allows you to make an informed decision about whether to proceed or cancel.

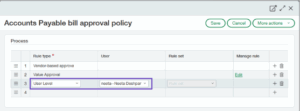

3. New Rule Type for Named Users in Bill Approvals

The Rule type column, which previously included both rule types and users with bill approval permissions, now contains only rule types.

To add a named user, select the new User Level rule type. Then, in the new User Level column, select an approver from the list of users with bill approval permissions.

If you already have named users as part of your bill approval policy, Sage Intacct automatically converts them to the new User Level rule type.

Accounts Receivable Enhancements:

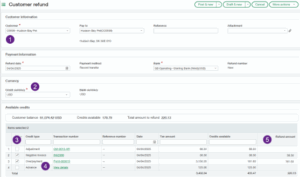

1. Record Customer Refunds (Early Adopter) – Coming soon!

Coming soon to Accounts Receivable is the ability to record customer refunds to streamline your refund management process, ensuring that the refunds that you initiate outside of Sage Intacct are accurately documented and the refunded credits are cleared. Eliminate the tedious step of creating balancing adjustments for refunded credits. Instead, record the amount refunded and pay available credits simply by selecting them.

On the new Customer refunds page, record a refund using the record transfer payment method. Enter the amount you refunded and match it to the customer’s available credits. Select from the customer’s available advances, adjustments, overpayments, or negative invoices, applying amounts partially or in full.

Once posted, Sage Intacct automatically clears the selected credits, keeping the customer account accurate and up-to-date.

Using the Customer Refunds Page:

- Select the Customer to view credits available to refund.

- Select a Credit currency to show credits with the same transaction currency.

- For customers with many credits available, sort and filter columns to find the credits you want to refund.

- Available credits show customer advances, adjustments, overpayments, or negative invoices that have a remaining balance.

- For each credit, Intacct shows the credit type, transaction amount, and credits available. Drill down into the transaction for more details.

- You can refund a partial amount by overriding the Amount to refund for the selected credit.

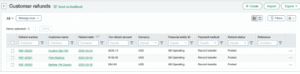

- Review and manage both draft and posted refunds on the Customer refunds list.

- Drill down into refund details and from there, drill down into the credits that were refunded.

2. New Warning When Reversing a Reconciled Advance

To help you avoid unintended changes to reconciled periods, a new warning has been added when reversing customer advances.

If you attempt to reverse an advance that has already been reconciled, Sage Intacct will notify you with a clear alert. This allows you to make an informed choice to either proceed with or cancel the reversal.

3. Retiring Customer Payment Service Integrations in 2025

Please note that customer payment service integrations with Authorize.net and PayPal will be retired on November 7, 2025.

After this date, these payment services and their APIs will no longer be supported for processing customer bank and credit card payments.

Cash Management Enhancements:

1. Import Credit Card Transactions for Reconciliation Using the Bank Transaction Assistant

You can now import credit card transactions for reconciliation and control who can perform these imports with a new permission setting. Plus, gain greater visibility with a detailed activity log. Multiple file formats are supported, giving you more flexibility when importing.

For CSV, XLS, and XLSX files, you can specify whether the file uses two columns (one for money in, one for money out) or one column with both positive and negative amounts. Based on your selection, choose a 3-column or 4-column file type. Additional optional columns are also available to provide deeper insights into your transactions.

Imported transactions appear in the Bank transactions list and remain there even after being included in a reconciliation.

2. Classic Import for Reconciliation is Retiring

The Classic import method will be retired no earlier than May 2026. If you haven’t transitioned yet, now is the time to switch and take advantage of the new features available.

Bank transaction assistant file import offers a modernized and more flexible approach:

- Imported transactions appear in a centralized location for all accounts on the Bank transactions page.

- Transactions you import remain in Sage Intacct, even after reconciliation.

- Multiple file formats are supported, giving you extra flexibility.

- You can increase control of who imports bank transactions using permissions.

- A new import activity list provides added insight.

- Import credit card transactions for reconciliation.

3. Reclassify GL Accounts for Credit Card Transactions & Partially Edit Paid Transactions

You can now reclassify the GL account for credit card transactions that are reconciled or in a Paid or Partially paid state—so long as the period remains open. You can also make partial edits to Paid credit card transactions.

To be eligible for reclassification, credit card transactions must originate in Cash Management. The following scenarios are not available to reclassify:

- The transaction originates from paying a bill in Accounts Payable.

- The transaction is associated with an employee expense report.

For Paid credit card transactions, you can update the Reference number, Payee, Description, Attachment, and line item Memo fields.

New Affiliate Entity Standard Dimension—General Availability:

The new Affiliate Entity standard dimension is now generally available in 2025 R2 for customers with a Consolidation subscription.

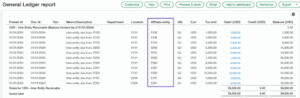

The Affiliate Entity dimension is a new Sage Intacct standard dimension that allows you to tag the entity affiliated with a transaction. Intacct pulls Affiliate Entities from the Entities list (Company > Setup > Entities), which is the standard source of entities in your company.

By enabling Affiliate Entity dimension tagging, you can enhance inter-entity activity tracking and gain clearer balance insights. This added layer of detail allows you to see distinct due to and due from amounts in Dimension Balance, General Ledger, and financial reports.

Use the Affiliate Entity dimension to automate eliminations in your consolidations by removing activity between entities within the same reporting book. Affiliate Entity works in Domestic, Global, or Advanced Ownership Consolidation. In Advanced Ownership Consolidation, it supports automatic eliminations across more complex direct and indirect inter-entity relationships.

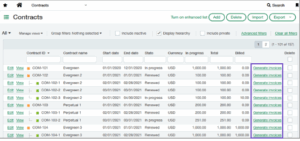

Contracts Enhancements:

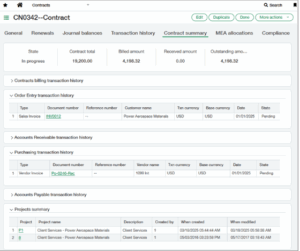

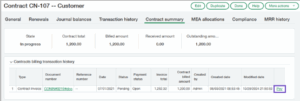

1. Contract Summary Tab

The Contract summary tab replaces the Billing transaction history tab, consolidating key details to help you better understand system-wide contract activity. Easily track Order Entry, Accounts Receivable, Purchasing, and Accounts Payable transactions—as well as related project insights—without switching tabs or running reports. This tab improves visibility and makes it easier for stakeholders to understand the full financial picture of a contract.

The Contract summary tab includes the following sections:

- Contracts billing transaction history: Shows Order Entry transactions that were created using Contracts Generate Invoices or are enabled for contracts. This section has no change to existing behavior.

- Order Entry transaction history: Shows Order Entry transactions that weren’t created using Contract Generate Invoices and are not enabled for contracts, but are tagged with the contract dimension.

- Accounts Receivable transaction history, Purchasing transaction history, and Accounts Payable transaction history: Shows transactions from these areas that are tagged with the contract dimension.

- Projects drill down: Shows projects associated with the contract or contract lines.

2. Quick Pay Shortcut

A Pay link is now available in the Billing Transaction History section on contracts (now located on the Contract Summary tab). Click the link to go directly to the Order Entry Payments page and pay the contract invoice—without leaving the Contracts application. The Pay link appears only when the invoice has a total due amount greater than 0, helping you act quickly and save time.

3. Generate Invoices Shortcut

A Generate Invoices link has been added to the Contracts list. This link opens the Generate Invoices page with the contract filter pre-filled, allowing you to quickly invoice a specific customer.

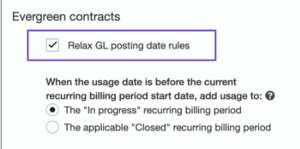

4. Relaxed GL Posting Date Rules for Evergreen Contracts

A new configuration setting has been introduced to help prevent evergreen contract renewal failures caused by closed periods, scheduling delays, or date mismatches.

When enabled, if a new contract line’s start date falls in a closed period during evergreen renewal, this setting automatically adjusts the GL posting date. Intacct uses the earliest date in the open period as the GL posting date instead, eliminating the need for a manual data fix.

Time and Expenses Split into Two Applications:

Previously, Time and Expenses was a single application. Now, Time and Expenses is split into two individual applications: Time and Expenses.

If you were subscribed to the Time and Expenses application, you are now automatically subscribed to both the Time and Expenses applications.

Each application now has its own dedicated menu. Some features—such as Approve Timesheets, My Timesheets, and Staff Timesheets—which were previously found under the Projects menu, have been relocated to either the Time or Expenses menus.

The Time and Expenses applications also have their own separate sets of permissions. Be sure to assign the appropriate permissions to users so they can complete tasks related to each application.

Fixed Assets Management:

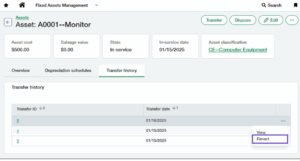

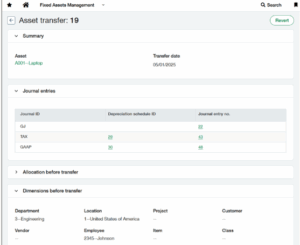

1. Transfer Assets Between Entities and Revert Transfers

Fixed Assets Management now supports transfers between entities that share the same base currency. Sage Intacct automatically creates inter-entity transfer journal entries to keep your General Ledger in sync with Fixed Assets Management, eliminating the need for manual updates.

Additionally, a new Revert Transfer option allows you to easily undo transfers. These enhancements improve how transfer journal entries are handled across multiple books and include a new Transfer Details page for better visibility.

2. Custom Declining Balance Depreciation Methods

Two new depreciation methods have been introduced to help meet financial and tax regulations in Australia, Canada, South Africa, and the United Kingdom:

- Custom declining balance with true-up (CDBT)

- Custom declining balance without true-up (CDB)

These methods allow you to customize the depreciation rate applied to assets under a declining balance method, providing greater flexibility when managing your assets.

- User-defined depreciation rate: When using a custom method, a new field called Depreciation rate is available on depreciation rules. You can select a rate from 1.00% to 100.00%.

- Calculation: In general, depreciation amounts are calculated using the following formula:

(Asset cost − Salvage value − Accumulated depreciation) × Depreciation rate

With true-up: For CDBT, the remaining depreciation is fully applied in the final period, ensuring the entire depreciable amount is accounted for.

Without true-up: For CDB, the depreciation rate is applied evenly throughout the asset’s life. Any remaining value at the end is treated as a loss upon disposal.

3. Depreciation Roll Forward Report

A new Depreciation Roll Forward report has been added to the Fixed Assets Management reports package. This report details changes in accumulated depreciation over a specified period, including the beginning balance, depreciation expense, and ending balance—helping you reconcile asset data more effectively.

4. Fixed Assets Management Reporting Now in ICRW

A prebuilt report—titled Assets, Depreciation, and NBV— is now available in the ICRW Report Library to help analyze fixed assets data quickly and accurately. You can also build your own custom reports using Fixed Assets Management objects to meet your organization’s unique needs.

5. Other updates to Fixed Assets Management

- Mark Assets as Intangible: Use the Asset Type field to mark an asset as intangible for reporting purposes. This does not affect other functionality.

- Edit Disposed Asset Fields: Make corrections to disposed assets without placing them back in service. Editable fields include: serial number, asset tag, asset type, description, parent asset, notes, attachments, and custom fields.

- Canadian Entity Tax Handling: When creating an asset from an AP bill for a Canadian entity, and ITC and Include Tax in Asset Cost are selected, the asset cost will only include the non-recoverable portion of the tax.

Optimize the Performance of Your Financial Reports:

To help improve efficiency, Sage Intacct now analyzes your financial reports in Financial Report Writer and offers optimization suggestions when you save a report. These recommendations are designed to help your reports run faster—or, in some cases, guide you toward a more effective reporting method.

When saving a report, you’ll receive a message if the system detects any of the following:

- The report contains more than 12 columns

- There are four or more expanded columns or rows

- An expanded column uses a “… to date” reporting period (e.g., Prior Year to Date)

- A column is expanded by a dimension with more than 100 values

The message will include specific suggestions to improve performance. If your report involves deeper data analysis, running it offline may be more efficient. In some cases, Sage Intacct may recommend an alternate reporting tool and provide helpful links to explore your options.

Unlock the Full Potential of Sage Intacct 2025 R2

Ready to take advantage of the powerful new features in Sage Intacct 2025 Release 2?

At CBIZ CompuData, our experts are here to help you explore what’s new, align these enhancements with your unique goals, and implement them seamlessly. We’re committed to helping you maximize every update—empowering smarter, data-driven decisions with confidence.

Contact us today to learn how CBIZ CompuData can support your team with Sage Intacct’s latest capabilities.