Are you looking to gain deeper insights into your business’s financial performance? In today’s competitive landscape, understanding and tracking key performance indicators (KPIs) is crucial for strategic decision-making and ensuring long-term success. KPIs serve as vital metrics that offer valuable insights into your business’s performance, financial well-being, and operational efficiency. From measuring profitability to assessing budget projections and liquidity, these indicators provide a comprehensive snapshot of your company’s health. Leveraging advanced accounting solutions like Sage Intacct can further improve this process by providing powerful tools to effectively track and analyze KPIs. In this blog, we delve into 5 essential KPIs that can empower you to make informed decisions, drive strategic initiatives, and guide your business towards enhanced efficiency and profitability.

1. Net Profit Margin

The Net Profit Margin KPI calculates your business’s effectiveness at generating profit on each dollar of revenue made. This financial management performance indicator is calculated by dividing the net profit of your company within a certain timeframe by your company’s total revenue in the same timeframe. This net profit considers not only costs of sale, but also other more nuanced expenses, like administration. This financial KPI is an excellent snapshot of your business’s profitability and aids in making both long-term and immediate financial decisions.

2. Gross Profit Margin

Similar to the net profit margin, the gross profit margin calculates profitability, however it only factors in the costs of sale when calculating the gross profit. It is computed by dividing the gross profit for a specific timeframe by the revenue generated during that same period. While easier to calculate than the net profit margin, the gross profit margin is less precise. Nonetheless, it serves as a valuable snapshot of data for finance managers and directors.

3. Budget to Actual Variance

How realistic are your budget projections? The budget variance KPI compares projected budget totals to actual operating budget totals. This financial KPI can help businesses more effectively predict budget needs by calculating and analyzing the differences between their projections and actual data.

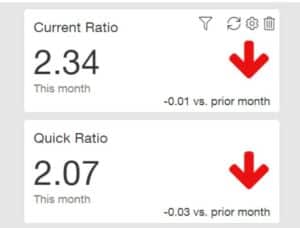

4. Liquidity Ratios

Liquidity KPIs reflect a company’s ability to meet its short-term financial obligations. The three most common liquidity ratios are the current ratio, quick ratio, and cash ratio. The current ratio weighs your current assets against your current liabilities to help you understand the solvency of your business. The quick ratio assesses your organization’s ability to use highly liquid assets to immediately satisfy all financial obligations or current liabilities. It can determine your ability to meet short-term financial obligations by measuring both your company’s wealth and financial flexibility. The cash ratio evaluates your organization’s ability to cover its short-term obligations using only cash and cash equivalents.

5. Revenue Analysis

Revenue Analysis helps an organization measure the behavior of business revenue. With Sage Intacct’s financial reporting capabilities and dimensional structure, organizations can track revenue by time period, customer, item, account, etc. By leveraging these comprehensive metrics, organizations gain a holistic view of their revenue, enabling informed decision-making and strategic planning.

By monitoring the above KPIs, you can gain a comprehensive understanding of your company’s health and make informed decisions to drive sustainable growth. Sage Intacct is specifically designed to help you seamlessly calculate and monitor these key metrics, empowering you to enhance business operations efficiently.

As a leading Sage Diamond Partner with over 30 years of experience migrating and implementing Sage solutions, CompuData is equipped with a team of certified Sage Intacct consultants who have the expertise, resources, and methodology needed to support you in leveraging Sage Intacct to its fullest potential.

If you’re interested in seeing these metrics in a customized demo for your organization and discovering how Sage Intacct can streamline your business processes and foster growth, email us!