As the SaaS industry recovers from the impact of the Coronavirus, automating your quote-to-cash process is one of the most important steps for SaaS companies to help increase operational cash flow. By integrating your CRM to your accounting software, you can increase your quote-to-cash processing by up to 30% to 75% and reduce your days sales outstanding (DSO).

What does your quote-to-cash process look like? For many SaaS companies, their quote-to-cash process is outdated and disconnected, which often leads to an inefficient sales cycle. This can cause many challenges from producing accurate quotes for customers to painful revenue recognition processes. However, the quote-to-cash process should be a top priority as it is a driving force that helps your organization bring in revenue. Additionally, with an automated process, you can bring cash into the business sooner to invest in growth.

Steps you can take to automate the quote-to-process include:

1. Streamline the sales process through integrating your CRM

Optimizing the quote-to-cash process has valuable benefits including accelerating the entire sales cycle. Your company can increase the speed of getting quotes out and ultimately close more deals.

2. Automate billing and order management

Through automating the day-to-day accounting and finance tasks from contracts to billing, you free up valuable time that can be spent focusing on strategic business planning.

3. Support complex revenue recognition

For SaaS companies, revenue recognition is a central part of your accounting process as you must comply to ASC606 standards. Easily meet these regulations with confidence using an automated quote-to-cash process.

4. Provide real-time visibility into your business

Lastly, you can easily analyze your pipeline, sale cycles, cash flow, and other business trends by having deeper visibility into your entire company.

How have these steps impacted other SaaS Companies?

GoGuardian is a SaaS company that uses Sage Intacct accounting software. They were able to cut their DSO by 50% and increase their operating cash flow by $7 million. They achieved over 800% ROI in their first year switching over to Sage Intacct.

Welltok is another SaaS company that improved its quote-to-cash efficiency with Sage Intacct. Intacct reduced its days sales outstanding and opened new cash flow. They also reduced their monthly close by 25% due to Intacct’s automation.

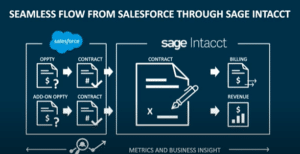

The integration between Salesforce and Sage Intacct allows companies to sync orders, contracts, projects, changes, and renewals in Salesforce with billing, revenue recognition, and receivables in Sage Intacct. Payments, pricing and billing are easily visible to salespeople, with Sage Intacct being the main system for price books.

See what your quote-to-cash process could look like with Sage Intacct-check out our Quote to Cash Process infographic here:

Every SaaS company should be focusing on automating their quote-to-cash process. As a result, you can increase the quote-to-cash efficiency, automate billing and revenue recognition, increase cash flow, reduce the DSO, and help your company scale.

Want to learn more about how you can strengthen your quote-to-cash process?

Our experts are here to help-